Jan 27, 2026

What Is Risk and Control Self-Assessment? Framework and Execution

By Fraxtional LLC

Risk and control self-assessment consumes significant time in many organizations, yet it rarely earns full confidence from boards or investors. Documentation is completed, and approvals are recorded, but decision-makers still question whether the assessment reflects real operating risk.

The problem is the disconnect between documented frameworks and day-to-day execution. RCSA is often performed on fixed cycles while transaction volumes, systems, vendors, and processes change continuously. Controls are assessed as designed rather than as executed, leaving exposure understated until issues surface through audits, lender reviews, or regulatory findings.

Despite these weaknesses, risk and control self-assessment remains critical because it is the only mechanism that ties risk exposure, control effectiveness, and ownership together. In 2024–2026, faster operating cycles and tighter scrutiny have raised the cost of weak RCSA programs.

This article explains what effective RCSA looks like in operating terms and how modern programs are evolving to stay credible under real conditions.

Key Takeaways

- Risk and control self-assessment only earns board trust when risks, controls, and ownership are anchored to how work actually runs, not how frameworks are documented.

- Calendar-driven RCSA cycles fail in high-growth and PE environments where systems, volumes, vendors, and processes shift faster than assessment schedules.

- Defensible RCSA relies on execution data such as losses, KRIs, control test results, and exception trends, not consensus scoring or historical assumptions.

- RCSA works when first-line operators own controls, escalation paths are explicit, and remediation is enforced, not when responsibility sits only with oversight teams.

- Firms maintain credible RCSA programs by embedding experienced risk and compliance leaders who continuously recalibrate exposure and intervene when controls weaken.

What Risk and Control Self-Assessment Actually Means in Operating Terms

In operating terms, a risk and control self-assessment defines where execution can break, what is in place to stop that break, and who is responsible when conditions change. It sits inside day-to-day operations, not outside them.

When RCSA is effective, leaders can trace a risk directly to a process, a control, and a named owner. When it is ineffective, risks exist on paper while failures surface in production systems, financial close, customer operations, or regulatory reporting.

Beyond Definitions and Frameworks

Risk identification, control design, and ownership must connect at the point of execution.

- Risk identification should focus on specific failure points such as delayed settlements, incorrect reconciliations, missed regulatory submissions, unauthorized access, or approval bottlenecks under volume. Broad labels do not expose how failures occur.

- Control design should describe the exact action that prevents or detects that failure. This includes who performs the control, when it occurs, and what evidence confirms it was completed. A policy or guideline without execution details does not function as a control.

- Ownership must be assigned to a named role with authority over the process. When ownership is shared, implied, or assigned to a department, failures persist without correction.

RCSA only works when these elements are anchored to how work is actually performed.

The Three Questions Every RCSA Must Answer

A risk and control self-assessment must answer three questions with precision.

- What can fail: This identifies the specific breakdown that could occur during normal or peak operations. Examples include incomplete financial close, incorrect customer charges, delayed exception handling, or unreviewed access changes.

- What prevents failure: This defines the control that directly addresses the breakdown. The control must be observable, repeatable, and tied to evidence, such as a reconciliation review, system restriction, approval workflow, or automated alert.

- What happens when controls break: This clarifies how failures are detected, escalated, and corrected. It should specify triggers, response timelines, and who owns remediation. Without this, control failures compound until impact is unavoidable.

When these three questions are answered clearly, RCSA supports operational control rather than retrospective explanation.

Why Traditional RCSA Models Fail in Growth and PE Environments

Traditional RCSA models were built for stable operating environments. Growth-stage and PE-backed companies operate under constant change. When RCSA does not move at the same pace as the business, it stops reflecting risk and starts documenting history.

Why These Failures Persist

Traditional RCSA models cannot keep pace with businesses that change quickly. Fixed cycles, subjective scoring, and fragmented ownership leave risk unmanaged between assessments and reduce confidence in reporting. In growth and PE environments, these gaps surface fast and weaken RCSA credibility.

If you want to see how disciplined risk execution fits into regulated operating environments, explore our guide on Risk Management in Banking: Types and Best Practices.

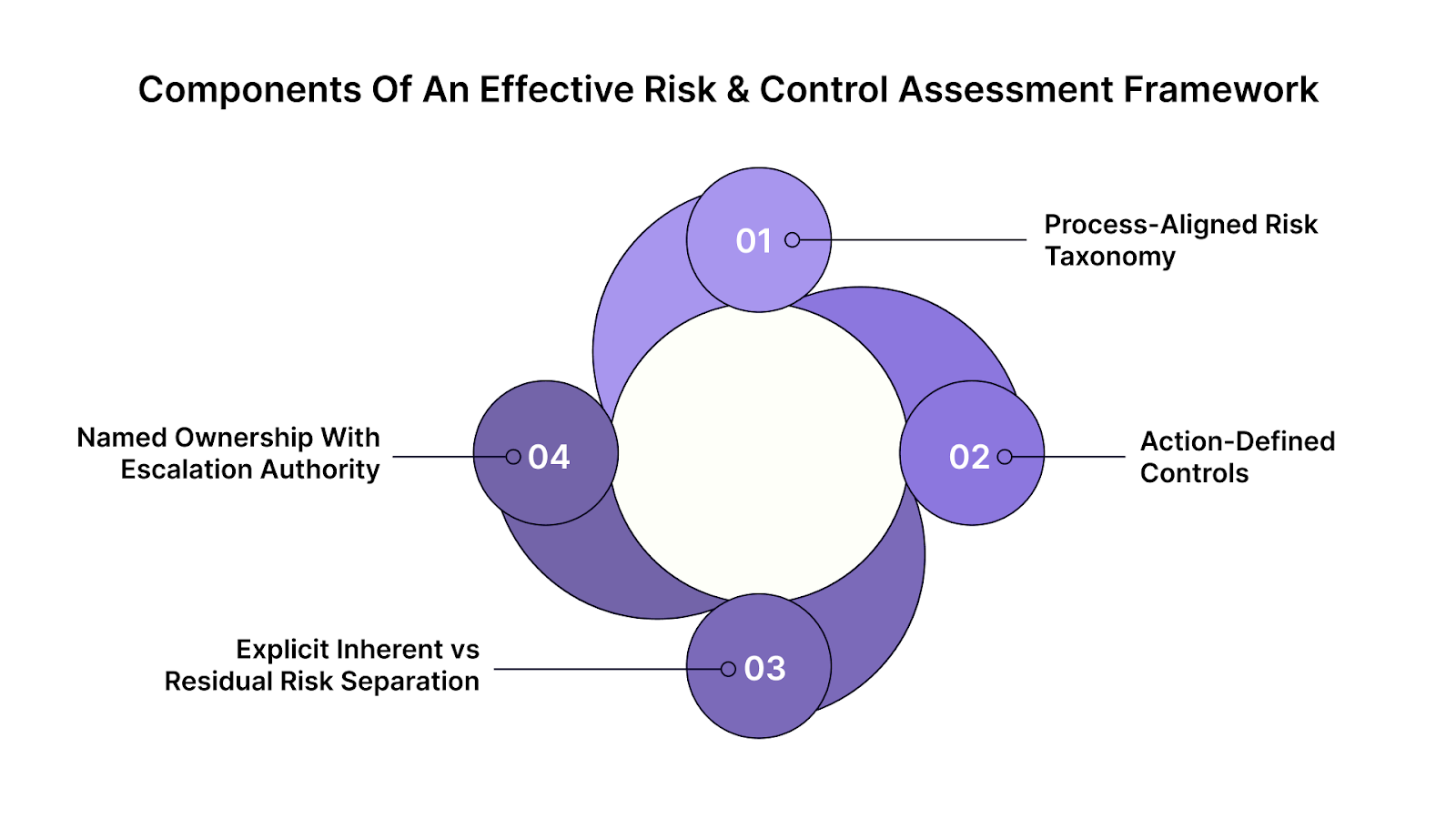

Core Components of an Effective Risk and Control Assessment Framework

An effective risk and control assessment framework is built to drive action, not documentation. Each component must support accurate exposure identification, control testing, and timely intervention when operating conditions change.

- Process-Aligned Risk Taxonomy: Risks are structured around end-to-end processes and decision points rather than departments, allowing clear origin tracing, ownership assignment, and elimination of duplicate assessments.

- Action-Defined Controls: Controls are specified by exact actions, timing, responsible operators, and required evidence, making execution verifiable rather than implied by policy language.

- Explicit Inherent vs Residual Risk Separation: Inherent risk establishes baseline exposure, while residual risk reflects post-control reality based on observed performance, allowing true control effectiveness measurement.

- Named Ownership With Escalation Authority: Each risk and control has a designated owner responsible for monitoring, response, and escalation when thresholds are breached, ensuring issues move from assessment to resolution.

When risk taxonomy, controls, measurement, and ownership align with real operations, RCSA becomes a tool for early intervention rather than a static record.

How Modern RCSA Programs Evolve From Static to Dynamic

Modern RCSA programs shift from calendar-driven assessments to condition-driven recalibration. Risk exposure is reassessed when business conditions change, using objective signals to update control effectiveness and residual risk in near real time.

Dynamic RCSA replaces static assumptions with live exposure signals, allowing faster intervention without increasing assessment overhead or eroding control discipline.

For a deeper look at how operational risk is governed in regulated financial environments, read our guide on Risk Management in Banking: Guide to Operational Risk Management Principles and Practices.

RCSA Execution Models That Actually Work

RCSA execution succeeds or fails based on how assessments are run inside the business. The model chosen determines data quality, ownership strength, and whether results lead to action or stall after sign-off.

- Facilitated Workshops When Effective: Work best for discrete processes, new risk areas, or post-incident reviews where cross-functional input is required, and participants have direct operational knowledge.

- Facilitated Workshops Where They Fail: Break down when used at scale, driven by surveys instead of discussion, or facilitated by teams without authority to challenge scoring and assumptions.

- Management-Led Analysis Strengths: Produces faster assessments with clearer ownership when managers control processes, data, and remediation budgets. Supports direct linkage between risk ratings and execution decisions.

- Management-Led Analysis Blind Spots: Prone to under-scoring and normalization when incentives favor stability, especially without independent challenge or objective data inputs.

- Hybrid Execution Model: Combines workshops for risk identification and calibration with management-led analysis for scoring, control validation, and remediation ownership.

- Why Mature Programs Converge Here: Hybrid execution balances operational insight, data discipline, and accountability while scaling across business units without assessment fatigue.

Execution models determine whether RCSA drives action or produces paperwork. Programs that align execution method to operating reality maintain credibility as complexity increases.

To understand how control execution is tested and validated in practice, continue with Audit Procedures and Controls for Effective Risk Management.

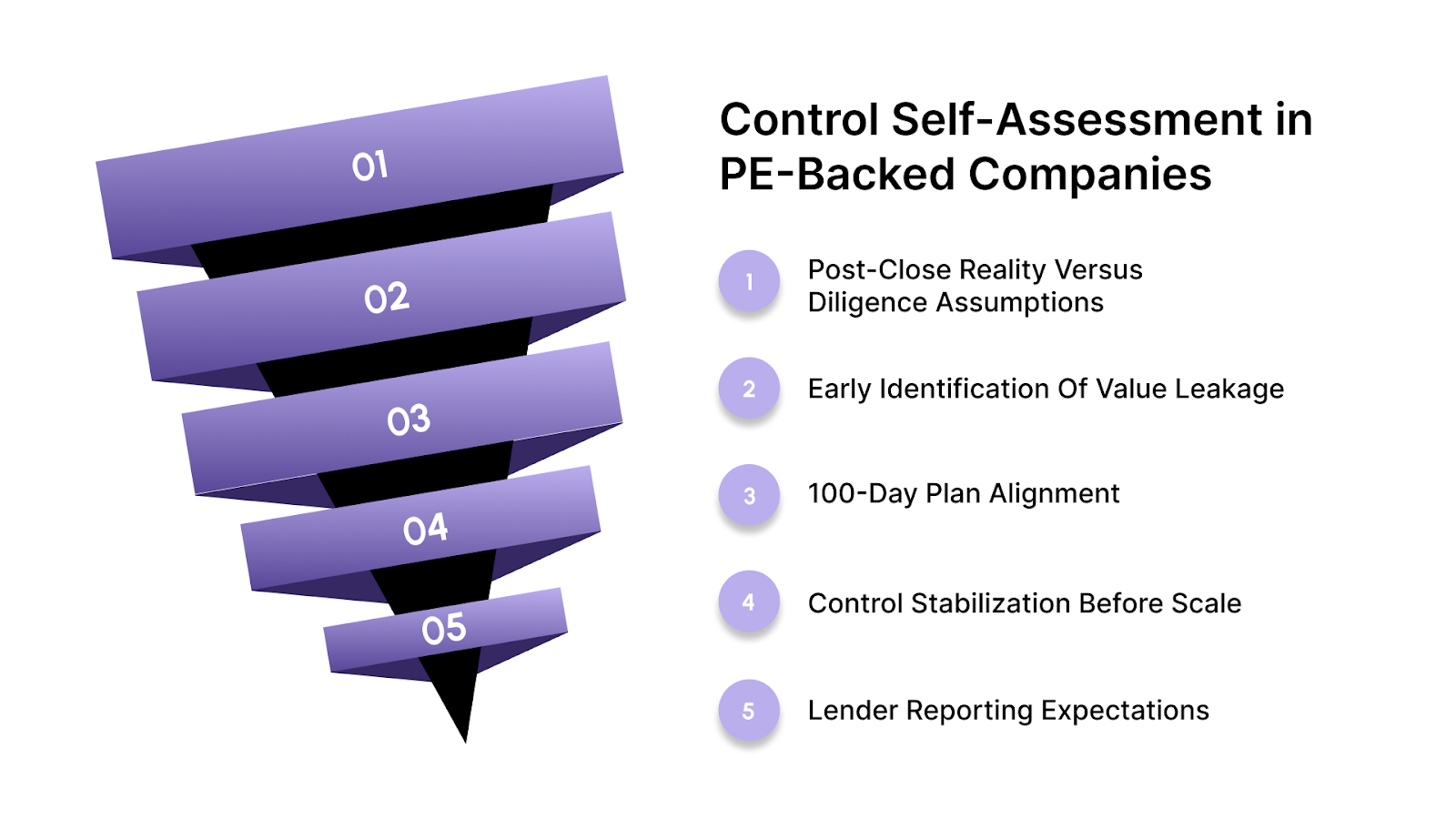

Risk and Control Self-Assessment in PE-Backed Companies

In PE-backed environments, RCSA functions as an execution control, not a compliance artifact. It exposes operational gaps immediately after close, supports disciplined 100-day execution, and underpins governance credibility with lenders and boards.

- Post-Close Reality Versus Diligence Assumptions: RCSA surfaces gaps between modeled controls and actual execution, including manual workarounds, incomplete integrations, misaligned approval thresholds, and unowned controls that were assumed effective during diligence.

- Early Identification Of Value Leakage: Weak reconciliations, delayed exception handling, uncontrolled spend, and revenue leakage become visible through targeted post-close RCSA before they materially impact EBITDA or cash flow.

- 100-Day Plan Alignment: RCSA timing matters because control maturity rarely matches deal velocity. Running focused RCSA during the first 30–60 days prevents execution initiatives from scaling on unstable controls.

- Control Stabilization Before Scale: RCSA helps prioritize which controls must be fixed immediately versus those that can mature later, avoiding rework during growth or integration phases.

- Lender Reporting Expectations: Lenders expect timely, defensible reporting on controls tied to cash management, covenant monitoring, and financial close discipline. RCSA provides evidence-backed visibility into these areas.

In PE-backed companies, RCSA protects value by revealing control gaps early, aligning execution with governance expectations, and supporting confidence at the board and lender level.

What “Good” Looks Like: Characteristics of a High-Credibility RCSA

A high-credibility RCSA is one that stands up under operational pressure, investor review, and regulatory challenge. Its quality is evident in ownership clarity, evidence-backed scoring, execution-level controls, and defensible reporting.

A credible RCSA reduces challenge from boards, lenders, and regulators by replacing narrative assurance with observable control execution and evidence-backed risk visibility.

If your RCSA needs execution ownership rather than periodic validation, Fraxtional embeds experienced risk and compliance leaders to keep assessments accurate as conditions change.

Common RCSA Failure Patterns and How Firms Correct Them

RCSA failures are rarely caused by missing frameworks. They stem from how programs are designed, owned, and enforced once execution pressure increases.

- Over-Engineered Frameworks: Excessive risk layers, scoring scales, and documentation slow assessments and dilute ownership. Firms correct this by reducing taxonomy depth, limiting scoring dimensions, and focusing on risks that materially affect financial, regulatory, or operational outcomes.

- Second-Line Owned Execution: When RCSA is driven primarily by risk teams, first-line accountability weakens. Correction requires shifting risk ownership and control execution to process owners, with the second line focused on challenge, consistency, and escalation.

- Ignored Control Breakdown Signals: Missed reconciliations, repeated exceptions, and delayed approvals are logged but not acted on. Effective programs define breach thresholds that trigger reassessment, escalation, and remediation ownership immediately.

Correcting these patterns turns RCSA from a documentation exercise into an operating control that prevents repeat failures and protects value.

For a practical view of how control automation strengthens ongoing risk oversight, read How Automated Transaction Monitoring Improves AML Compliance.

How Fractional Risk and Compliance Leadership Strengthens RCSA Execution

Fractional risk and compliance leaders are used when internal teams lack the capacity or experience to run RCSA at operating speed. Their value is execution ownership during periods where control discipline must improve without slowing the business.

- Immediate Execution Ownership: Fractional leaders assume direct responsibility for RCSA delivery, control validation, and remediation tracking, eliminating gaps caused by shared or transitional ownership.

- Compression of RCSA Timelines: Assessments, control testing, and remediation plans are completed in weeks rather than quarters by applying proven execution playbooks and prioritization discipline.

- Board-Ready Risk Translation: Fractional leaders convert operational findings into concise, defensible board and lender reporting that links exposure, controls, and corrective actions clearly.

- Stabilization During Change Events: During acquisitions, integrations, restructures, or system migrations, fractional leaders recalibrate RCSA in parallel with execution rather than pausing for framework redesign.

Fractional risk and compliance leadership closes execution gaps quickly, restoring RCSA credibility without adding permanent overhead or slowing transformation.

How Fraxtional Helps Firms Operationalize Risk and Control Self-Assessment

Fraxtional focuses on turning RCSA from a documented requirement into an operating discipline. The model centers on embedded leadership, execution ownership, and regulator-ready outputs rather than abstract frameworks.

- Embedded Named Leadership: Fraxtional places experienced CCOs, CROs, CAMLOs, MLROs, and BSA Officers directly inside the organization, accountable for RCSA execution, control oversight, and regulatory outcomes.

- Evidence-Based Risk Assessment Delivery: RCSAs are built from policy review, control walkthroughs, transaction testing, and operational interviews, ensuring risk ratings are defensible under audit, sponsor bank, or regulator scrutiny.

- Execution-Linked Control Mapping: Controls are mapped to real workflows across product, engineering, vendors, and operations, not policy language, exposing where controls exist only on paper.

- Board and Sponsor Bank–Ready Outputs: Fraxtional delivers concise risk reports, severity-ranked findings, and remediation plans that withstand lender reviews, investor diligence, and supervisory exams.

- Hands-On Remediation Ownership: Beyond identifying gaps, Fraxtional leaders guide remediation, assign owners, validate fixes, and maintain audit trails until issues are fully resolved.

Fraxtional embeds accountable operators who execute RCSA end-to-end, producing risk assessments that regulators trust and leadership can act on immediately.

Conclusion

Risk and control self-assessment earns credibility when it keeps pace with how risk actually emerges inside the business. That requires more than periodic reviews or well-structured templates. It requires judgment, operational context, and the ability to recalibrate exposure as conditions change.

As scrutiny from boards, lenders, and regulators continues to increase, RCSA has become less about completeness and more about reliability. Programs that stay accurate under pressure do so because experienced operators are actively maintaining them, challenging assumptions, and intervening when controls weaken.

Fraxtional supports firms that need their risk and control self-assessment to function as an operating discipline, not a reporting exercise. By embedding seasoned risk and compliance leaders into the business, Fraxtional helps organizations maintain credible, execution-ready RCSA programs that hold up under real scrutiny.

Connect with Fraxtional to strengthen your RCSA with leadership built for execution.

FAQs

Risk and control self-assessment evaluates risk and control performance within day-to-day operations, owned by process leaders. Audits test independently and retrospectively. RCSA operates continuously and closer to execution.

Only if the risk and control assessment is event-driven, static cycles fail during product launches, integrations, or volume spikes because controls degrade faster than scheduled reassessments.

Execution evidence. System logs, reconciliations, exception queues, approval records, and control test results matter more than policy statements or designed controls.

Ownership must sit with operators who control the process, not oversight functions alone. First-line ownership with clear escalation is what gives risk and control self-assessment credibility.

There is no fixed cadence. Updates should occur when trigger events happen, such as system changes, control failures, regulatory findings, or material shifts in transaction behavior.

blogs

Don’t miss these

Let’s Get Started

Ready to Strengthen Your Compliance Program?

Take the next step towards expert compliance solutions. Connect with us today.